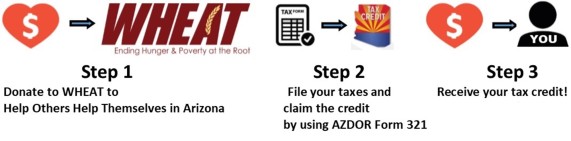

Donations to Qualifying Nonprofits for Arizona Tax Credits

The state of Arizona provides an incredible incentive for taxpayers who donate to certain qualifying charities like WHEAT. Thanks to the Arizona Charitable Tax Credit, you can donate up to $841 and get it right back on your Arizona tax return.

Donations made for the 2023 Arizona Income Tax Returns can be up to $841 for joint filers and $421 for single filers. The previous maximum amount that could be claimed on the 2022 Arizona Income Tax Return was $800 for joint filers and $400 for single filers. Learn more about this change.

Arizona taxpayers considering donations to qualifying nonprofit organizations for Arizona tax credits on their 2023 income tax returns must still make those contributions by April 15, 2024. Qualifying charitable organizations include 501(c)3 nonprofit organizations, foster care organizations public schools and certified school tuition organizations.

In Tax Year 2023, Taxpayers making Contributions to Qualifying Charitable Organizations and filing:

**“single” and “head of household” status may claim a maximum credit of $421. ($470 in 2024)

**“married filing separate” may claim a maximum credit of $421. ($470 in 2024)

**“married filing joint” may claim a maximum credit of $841. ($938 in 2024)

WHEAT is one of those charities found on page 21 of the Arizona List of Qualifying Charitable Organizations. Click here for a list of the Arizona Qualifying Charitable Organizations

By making a donation to WHEAT, you will be helping someone begin to help themselves within our community. Think of it as a down payment on their future.

Help us continue our mission to educate, advocate, motivate and empower individuals in the fight against hunger and poverty by donating today!

Each Year WHEAT:

• Sponsors high school teens living in at-risk situations in its ICan Youth Leadership Program;

• Trains and Graduates Individuals in its Management Training and Mentoring Program leading to employment and living wage jobs;

• Staffs SNAP Outreach partnerships at locations around the state of Arizona, providing enrollment in nutrition programs to eligible individuals;

• Continues to encourage self-sustenance for artisans and their families living in poverty around the globe, including Arizona, through WHEAT’s Fair Trade initiative providing necessary income for families to feed, clothe and educate themselves through the sale of their handicrafts;

• Provides professional business wear, free of charge, appropriate for the interview or work day through The Clothes Silo;

• Presents lectures, trainings and workshops on ending poverty and hunger through education and action;

…and much more.

Your donation, whatever amount, will help us to continue to help others become self-sustaining, participating members of our community.

Thanks for giving a gift that will ultimately give twice!

Mail your Tax Deductible Donation to:

WHEAT

4000 North 7th Street, Suite 118

Phoenix, Arizona 85014

A Qualifying Charitable Organization is a charity that meets ALL of the following provisions:

A Qualifying Charitable Organization is a charity that meets ALL of the following provisions:

- Is exempt from federal income taxes under Section a 501(c)(3) or is a designated community action agency that receives community services block grant program monies pursuant to 42 United States Code Section 9901.

- Provide services that meet immediate basic needs.

- Serves Arizona residents who receive temporary assistance for needy families (TANF) benefits, are low-income residents whose household income is less than 150% of the federal poverty level or are chronically ill or physically disabled children.

- Spends at least 50% of its budget on qualified services to qualified Arizona residents.

- Affirm that it will continue spending at least 50% of its budget on qualified services to qualified Arizona residents.

A charity must apply for and meet all requirements of the law to be considered as a Qualifying Charitable Organization.

You report the name of the Qualifying Charitable Organization you donated to as well as the dollar amount of your donation to the Department of Revenue on Form 321. You must also total your nonrefundable individual tax credits on Form 301 and include all applicable forms when you file your tax return.

WHEAT’s QCO Code needed to complete your form is: 20391

If you would like to make a tax credit donation to WHEAT, you may do so ONLINE NOW or contact WHEAT@HungerHurts.org or call 602/955.5076.

Direct Benefits to You for Giving

- A charitable contribution made before December 31st will help your community and could directly benefit you.

- You could receive a dollar-for-dollar tax credit ($421 maximum for individuals, $841 for married couples).

- This contribution may offset your Arizona income tax obligation and is in addition to school tax credits!

FREQUENTLY ASKED QUESTIONS

- Is this the same as the Working-Poor Tax Credit?

Credit for Contributions to Qualifying Charitable Organizations was formerly known as the Working Poor Tax Credit. Donors may take up to $421 in tax credit and couples filing jointly may take up to $841 in tax credit for gifts made to WHEAT. - Can I take this credit in addition to other credits such as credit for donations to schools and foster care agencies?

Yes. Each tax credit is separate, so you can take the Charitable Tax Credit in addition to tax credits for schools and foster care agencies. See Form 301 on the Arizona Department of Revenue’s website for other credits you may be able to take. - Do I have to donate $421 or $841 at once?

You do not have to donate the whole amount at once. Donations given throughout the year that add up to the $421 ($470 in 2024) and $841 limits qualify for the tax credit ($938 in 2024). We can even set up a monthly gift option for you to spread the gifts out over the year. For more information, please call Jody at 602.955.5076. - Do I need a special form from WHEAT to take the Tax Credit?

You simply need a receipt from WHEAT, which every donor receives by email or in the mail after making a monetary gift. The form you need to take the tax credit is Arizona Form 321, which is available on the Arizona Department of Revenue’s website and is included with many of the available self-filing tax programs like Turbo Tax. You will need to include WHEAT’s QCO Code: 20391 - Can I take the Tax Credit by donating clothing or other tangible items?

No. The Tax Credit only applies to voluntary cash donations. - What is WHEAT’s QCO Code? WHEAT’s Qualifying Charitable Organization (QCO) code is 20391 for the Arizona State Tax Credit.

For more information about the tax credit, please visit

Arizona Department of Revenue

or call 602/255.3381